Our Head of Finance, James Longhurst, delivered our recent #whiteboardwednesday on all things Finance Reporting. Here are Beth’s top takeaways:

- The objective of financial reporting is to track, analyse and report your business income. This is a requirement for every business, from the smallest to the largest

- The size of business, and markets in which it operates, will dictate the rules which must be followed i.e., which reporting standards must be followed (e.g., IFRS, US GAAP). Can be subtle differences, but have significant impacts for large multi-nationals

- The size will also dictate where information is published, and what additional requirements may exist (e.g., SOX compliance for the US markets). Errors or fraudulent activity can be big (and share price impacting) news

- The purpose of these reports is to examine resource usage, cash flow, business performance and the financial health of the business. This helps you and your investors make informed decisions about how to manage the business

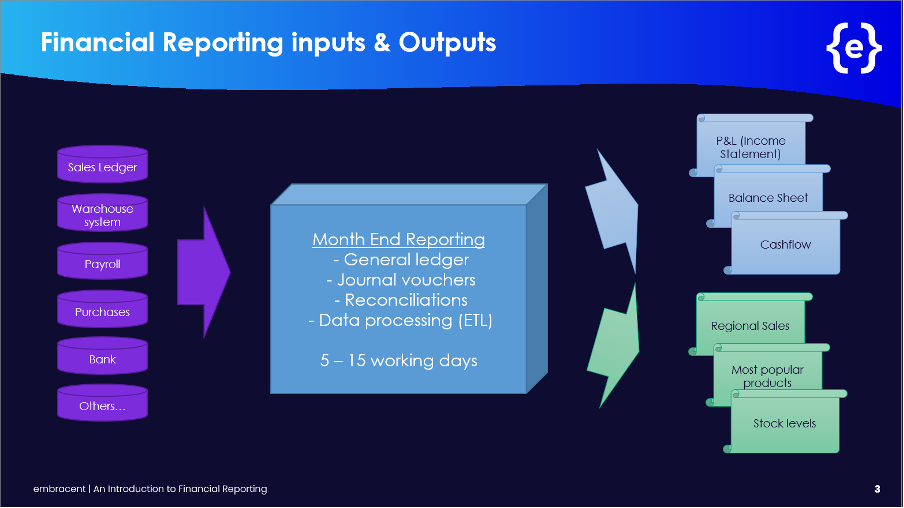

- Financial reporting looks at the entire business and represents its overall performance. Management reporting takes a more detailed look at the business and displays results from different segments. Rather than the whole company, management reports can concentrate on a particular job, department or team

Finance Reporting:

- What was our revenue?

- What was our profit?

- How much were salary costs?

- What is the company value?

- Cashflow performane

Management Reporting:

- What was the most popular and profitable product?

- What impact did our campaign have?

- Who are our top sales people?

- Which is the most profitable region?

- What is our stock turnover rate?

- How did (an event) impact our sales in that area?

- What are our sales by demographic?